Table of Content

The home inspection is one of the most important and essential steps of the home buying process. It allows a licensed inspector to look over the potential purchase property for defects. However, this is negotiable and there are some cases where the seller might pay for it.

A strange sound or smell could indicate an underlying issue that could affect your HVAC system, leading to increased heating and cooling costs, or worse, needing to replace it with a whole new system. An HVAC inspection provides a clearer picture of the home’s heating and cooling system, and can even give you recommendations for repairs or energy-efficient upgrades. The question of who pays for a home inspection when buying a house is dependent on what the inspection is intended to accomplish. This is why the buyer is the one who usually pays for home inspections. However, there are reasons for the seller to be the one who pays for house inspections.

Waiving the Inspection

That means you can put anything on the table when it comes to bargaining. That can include asking the seller to pay for the home inspection, if it comes out favorably and you end up buying the property. If you want to learn more about the process of buying or selling a home, check out more of our great real estate content. Even if the inspector identifies a major problem and the buyer decides to withdraw their offer to purchase the home, the seller doesn't have to reimburse the buyer for the cost of the inspection. Certified home inspectors do home inspections , and licensed real estate appraisers do appraisals.

Depending on where you live, septic inspection costs normally range from $300 to $600. Still yet, a third alternative may involve the seller giving the buyer some closing credits that are equal to the repair cost. While certain states require sellers to cover inspection costs, others assign such responsibilities to buyers.

Who Pays for the Septic System Inspection When Buying A Home?

Termite inspection reports describe items as either “Section 1” or “Section 2”. To clarify the differences in the two inspections, we need to identify what each inspector does and some of the terminology used. For terminated contracts, appraisal issues accounted for 11% — a higher percentage than any other issue. Let’s talk about the different scenarios that accompany your appraisal outcome. The appraiser will fill out a standard home appraisement form, often Fannie Mae’s or Freddie Mac’s Uniform Residential Appraisal Report, to share with the lender. Your lender should provide you with a copy of the appraisal within about seven business days .

If a buyer is purchasing a home, the seller is usually responsible for paying for the inspection. However, if a homeowner is selling their home and the buyer requests a termite inspection, the buyer is usually responsible for the cost of the inspection. In some cases, the seller may agree to split the cost of the inspection with the buyer. In either case, it is important for both parties to agree on who is responsible for paying for the termite inspection before the transaction is completed. While professional termite repair may restore termite damage, homeowners should first contact a termite specialist for assistance. If a licensed pest control company has found no termites remaining, it should not be necessary to make any repairs until the risk of further termites infestations has been eliminated.

What Will the Housing Market Look Like in 2023? A Buyer’s Guide

This is a general guide on what you should know as either a buyer or a seller who doesn’t want these responsibilities to be a surprise. To approve your loan, lenders usually insist that the septic system passes the inspection. In most cases, the seller agrees to pay for any repairs, which must be done before the closing.

Appraisers must meet congressionally authorized standards and qualifications, plus any qualifications set by the state in which they are based. She is a former newspaper reporter with more than a decade of professional writing experience. Having bought and sold one house, then relocating and purchasing another, Kaitlynn knows well the challenges and joys of home ownership. When it comes to the foundation, they will look for visible cracks and any damage from the root systems of large nearby trees.

Find out what needs to be fixed before you put your house on the market

Some mortgage lenders require a clear termite or pest inspection before they’ll finance your home. And certain types of loans, including some VA and FHA loans, require a clearance letter showing that an inspection took place and that the seller addressed any issues. Of course, buyers can always request one if they suspect any issues or if they just want peace of mind. Sellers pay real estate commissions, which typically total between 5% to 6% of the sale price. This amount is paid to the listing agent, who then shares roughly half with the buyer’s agent. While some aspects of closing costs can be negotiated into the contract between buyer and seller, certain things are typically paid by one party or the other.

The appraiser and lender are not in communication other than issuing the work order, and all information the appraiser produces is the property of the lender, but buyers are entitled to a copy. Most lenders charge from $300 to $450 for the appraisal, which lenders require you to pay for before the appraiser comes out. Section 1 items typically fall into the closing costs for the seller, meaning sellers pay for these treatments. This includes the cost of remediation, like tenting or spraying to eliminate an active termite infestation.

Technicians with Terminix will inspect your home to ensure that your termite and pest problems are properly addressed. Terminix’s annual pest control plans can include termite treatment. Because the company has money-back and servicing guarantees, it must be reliable. They cause a staggering $5 billion in property damage in the United States each year.

Some buyers though, particularly those who are purchasing in competitive seller’s market, may make an offer with less stringent contingencies. One of these includes agreeing to purchase the property “as is,” meaning that they can’t back out even in the presence of necessary repairs. Even though a home inspection isn’t required, most buyers pay for one before the deal is finalized to help identify unknown issues with the house. Home inspections give the buyer a chance to renegotiate or back out of the deal if the inspector finds anything unexpected. Home buyers typically pay for a home inspection before they close on the purchase of their new home. The cost of a home inspection is separate from the closing costs that are calculated and paid at the end of a sale.

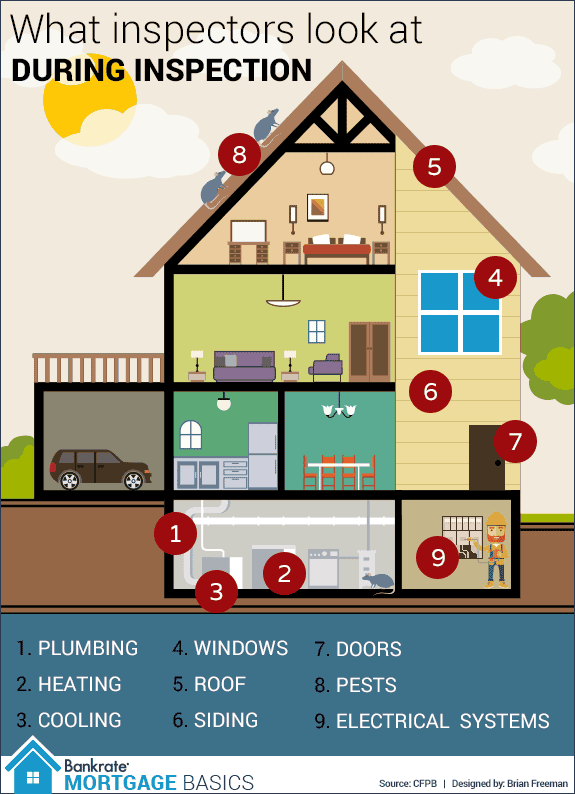

And all of that comes even before the first mortgage payment is due. A general home inspection evaluates the home’s overall condition and identifies any problem areas. It is a common contingency a buyer includes in their offer when they’re purchasing a new home. A specialized inspection will usually include items that are not covered in a standard inspection, such as pest issues, mold, radon, lead-based paint, asbestos, sewer and septic systems. Once there’s a home inspection done on the house, the seller has to disclose it with any potential buyers.

It's also possible that an electrical orplumbing systemis beyond repair, which means replacing the entire system. Home inspections give buyer's a heads-up about potential problems, giving them a chance to back out of a contract on a home with severe deficiencies. If the inspector finds structural damage or soft spots on the roof, it can cost significant money to repair. Poor grading and drainage often result in water leaking into the basement or causing erosion of the home's foundation.

Understanding your appraisal

It's best for the home seller not to be present during the home inspection. Real estate agents often have relationships with home inspectors, so your agent might be able to recommend one. After the inspection, a home inspector will prepare a written report that documents all of their findings. Even though most states have seller disclosure laws requiring home sellers to tell the buyer about any known defects in their home, the seller might not be aware of some problems. A home inspection usually takes place shortly after the seller accepts an offer. In areas with a high demand for real estate, the need for inspectors might spike up their rates.